In our preceding article, we covered the fundamental aspects of Dynamics 365 Cost Accounting, elucidating essential concepts like the distinction between Financial Accounting and Cost Accounting, the significance of Cost Accounting for organizational success, and the intricacies of Cost Accounting Dimensions and Hierarchy. If you haven’t already, I encourage you to explore that article as a valuable primer before delving into the depths of Overhead Calculation.

Now, we embark on a journey to illuminate the realm of Overhead Calculation itself. However, to follow on this endeavor with clarity and insight, it is imperative to first grasp the concept of Overhead Costs and their profound impact on a company’s financial landscape. Let us take a moment to delve into the intricacies of Overhead Costs, setting the stage for a comprehensive exploration of Overhead Calculation in Dynamics 365 Cost Accounting.

Overhead Costs

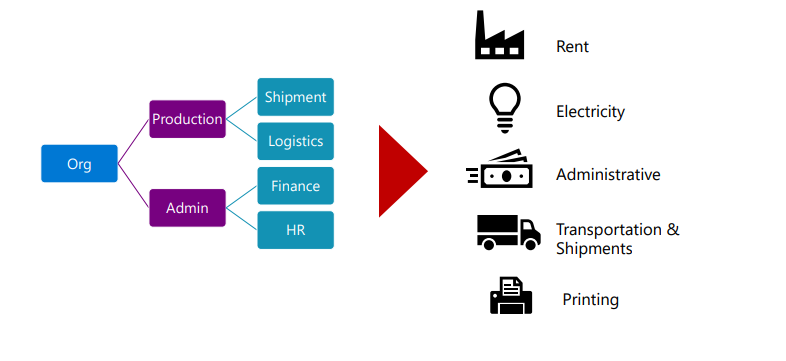

Overhead Costs encompass expenditures that cannot be directly attributed to a specific cost center, product, service, or department, yet they play a crucial role in bolstering overall production and operational endeavors.

These costs form an indispensable foundation for supporting various business activities, spanning a wide spectrum from shipping and logistics to finance and human resources. Unlike expenses that are specifically assigned to a particular department, overhead costs possess the versatility to be utilized across different cost centers within an organization. They serve as essential enablers, facilitating the smooth functioning of diverse operational facets without direct attribution to a single entity.

Overhead Costs Calculation

The significance of overhead cost calculation lies in its pivotal role in allocating overhead costs to pertinent cost objects. By engaging in this process, teams are equipped with a comprehensive understanding of the origins of overhead costs and the appropriate assignment of these expenses.

This allocation process takes place based on well-defined criteria and system cost policies, ensuring a structured and systematic approach. Through meticulous analysis and adherence to specific guidelines, overhead costs can be accurately attributed to the relevant cost objects, enabling teams to gain valuable insights into the distribution and utilization of resources. Consequently, this practice enhances decision-making processes by providing a clear overview of the impact of overhead costs on various operations and cost centers within the organization.

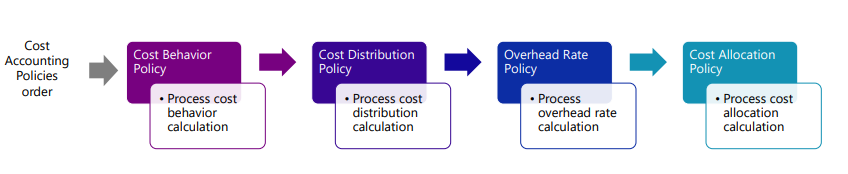

There are 4 specific accounting policies which overhead calculation is following, in order:

- Cost Behavior Policy – shapes fixed and variable cost behavior;

- Cost Distribution Policy: It distributes costs based on the allocation criteria.

- Overhead Rate Policy: A predefined overhead rate is utilized to assign costs to the relevant cost objects.

- Cost Allocation Policy: This policy facilitates the transfer of balanced costs between different cost objects. It operates within the framework of the Cost Accounting Ledger and supports the overhead calculation process.

These policies and rules are applied to each journal line, generating cost entries as the output. Therefore, complete traceability is always maintained.

Allocation Bases

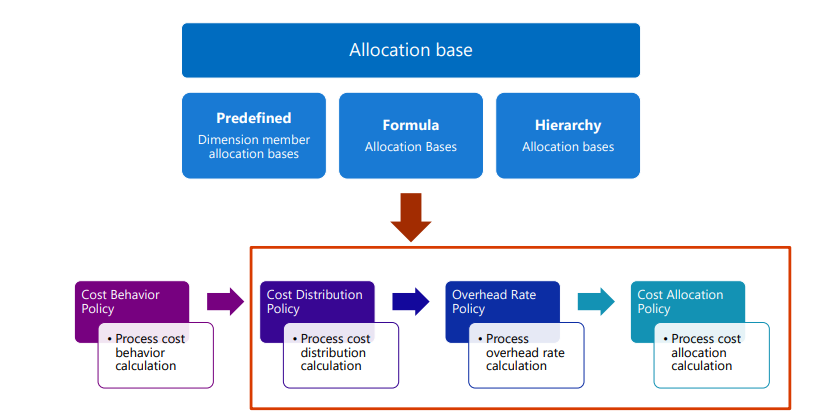

An allocation base is a foundation upon which Cost Accounting distributes or allocates overhead costs. Since overhead costs cannot be directly attributed to specific cost objects, we use allocation bases to assign overhead costs to relevant cost objects.

There are three types of allocation bases:

- Predefined Allocation Bases: These are dimension member allocation bases that are automatically created when financial data is imported into the Cost Accounting Ledger.

- Formula Allocation Bases: This approach allows for the flexible creation of new allocation bases using different formulas and operators.

- Hierarchy Allocation Bases: Multiple allocation bases can be created by leveraging predefined allocation bases.

These allocation bases are utilized when defining cost accounting policies, particularly the overhead policy and cost allocation policy. The cost behavior policy does not require an allocation base.

Calculating and Allocating Costs

When it comes down to financial accounting and certain costs specifically – all expenses are being registered as a specific sum without giving detailed managerial insights. But, in order to make sure managerial insights are error-free across all organizational branches, cost accounting needs costs to flow through the organizational structure. A such flow must be based on either precise consumption records or fair assessments. In order to record specific costs, the following steps can be applied:

Step 1: Cost Behavior Calculation

Once cost entries are brought in from the source data, they are allocated as ‘Unclassified Costs’ in cost accounting in the first place. Then, the entries can be re-allocated to either Fixed or Variable costs, based on cost behavior policies.

Step 2: Running Cost Distribution Calculation

Cost distribution stands for readjusting costs from one cost object to one or more other cost objects by using a relevant allocation basis. Needless to say that cost distribution instantly appears at the level of the primary cost element of the original cost.

Step 3: Executing Overhead Rate Calculation

The overhead rate is meant to attribute costs to one or more particular cost objects. The assignment is hinged on a prearranged cost rate and the magnitude derived from the allocated allocation basis.

Step 4: Performing Cost Allocation Calculation

Lastly, Cost Allocation calculation. The process consists of allocating the unsettled balance of a cost object to other cost objects by enrolling an allocation basis. D365 Finance maintains the reciprocal allocation method, which knows the mutual services exchanged between auxiliary cost objects.

The appropriate order for performing the allocations is being determined & executed automatically, on the fly, by the system. Each cost object’s balance is allocated using a single allocation basis, with support for allocations across different dimensions and their corresponding members. The cost control unit governs the allocation order.