Cost accounting helps you to analyze, summarize, and evaluate cost data so that management can make the best possible decisions for cost control, price updates, budgets, and so on. Dynamics 365 cost accounting is just data collected from various sources, such as the general ledger, subletters, budgets, and also imported data from outside of Dynamics 365.

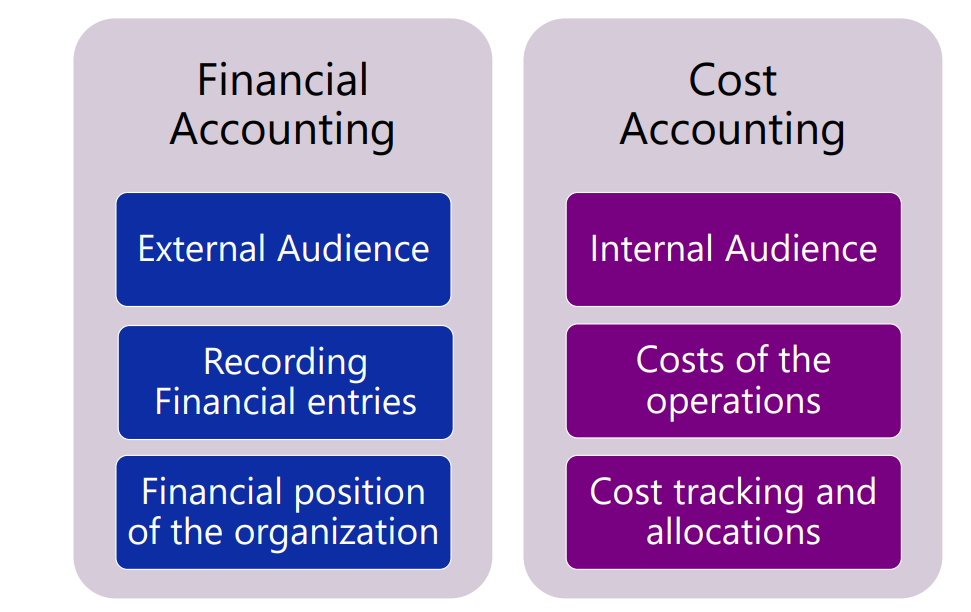

Both financial accounting and cost accounting are important for an organization, but they do have some differences.

The main objective of financial accounting is to provide information about the financial situation, performance, and cash flow of an organization to external stakeholders such as investors, creditors, and regulators. On the other hand, the main objective of cost accounting is to provide information to internal stakeholders such as managers, helping them to make better decisions about cost control, pricing, and resource allocation.

Next, Financial accounting helps to record financial entries in the books of finance while in cost accounting you will find the record of the cost of all your operations.

Finally, financial accounting is to show the financial health of the organization using financial statements, balance sheets, etc.

Why Cost Accounting is Important?

Cost accounting is important for multiple reasons, such as:

- Cost Tracking, which helps to classify and analyze costs, so teams can realize where they are spending more and whether any actions should be taken;

- Cost Structure, which provides detailed information about the costs of various activities, processes, and products. This information is essential for understanding organizational costs structure plus for identifying areas where costs can be reduced;

- Internal Managerial Decisions, which help management with the actionable information to be used to make informed decisions related to pricing, cost optimization, etc. By analyzing the cost of producing goods and services, managers can determine the appropriate pricing strategy;

- Better Budgeting – with an understanding of the cost of different activities and processes, managers can estimate the cost of future operations and develop realistic budgets;

- Set Efficiency Standards.

Cost Accounting for an Organization

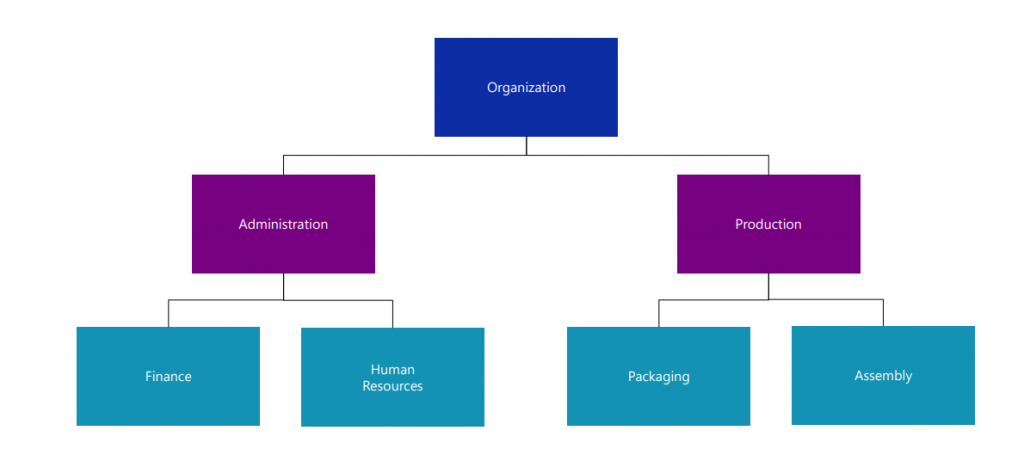

The cost accounting module enables the analysis of costs across an organization. And, to facilitate the analysis, everything shall be structured hierarchically concerning the relevant cost objects.

We are talking about an organization that is structured into a hierarchy, where the admin node aggregates the cost of human resources and finance, while the production node aggregates the cost of packaging and assembly.

Cost Accounting Dimensions

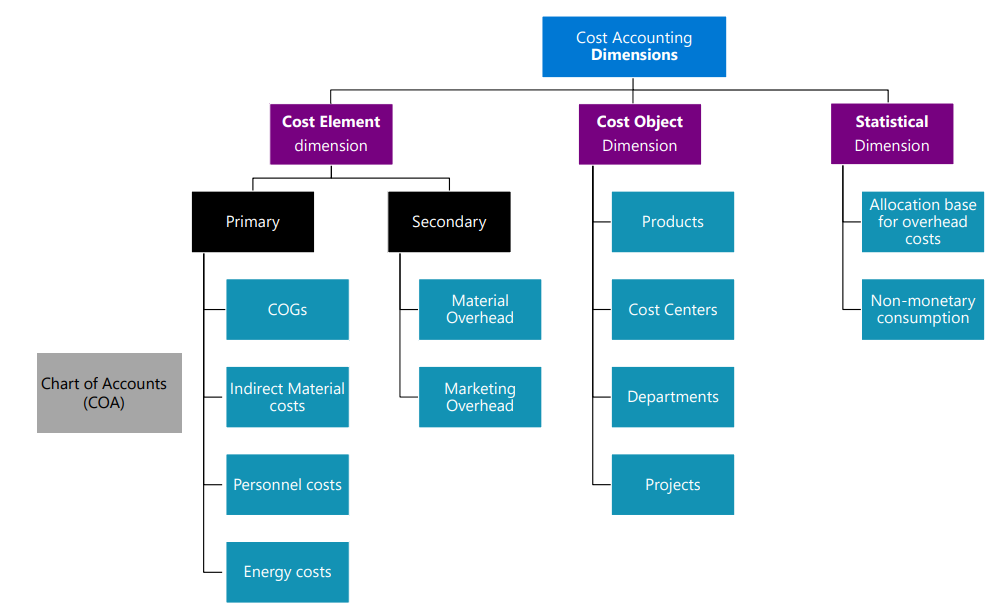

Now, let’s talk about the importance of building blocks of cost accounting in Dynamics 365 – which are cost accounting dimensions. Cost accounting dimensions are the core of Dynamics 365 and they are being used to categorize data in the module.

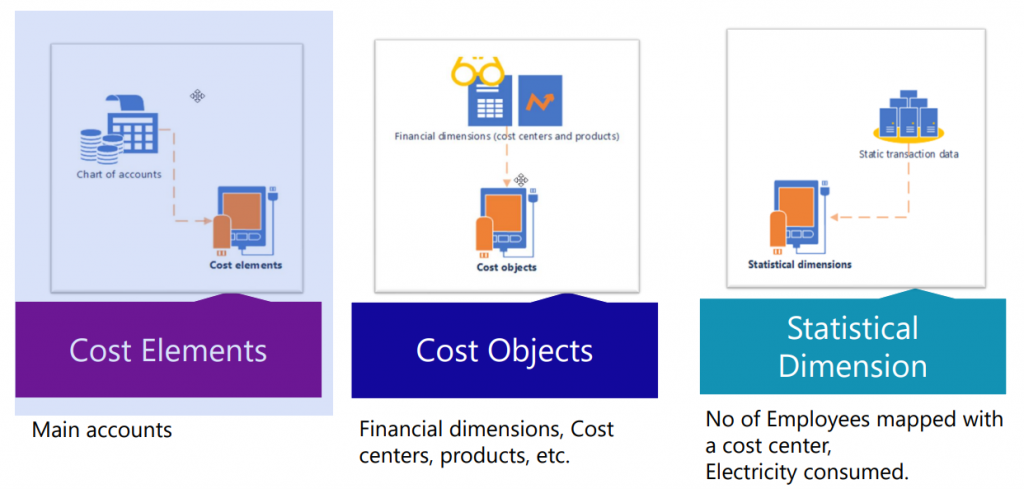

There are just three main cost accounting dimensions in cost accounting:

- Cost Element Dimension – which is needed to track and categorize costs;

- Cost Object Dimension – which is used as a cost control unit in the cost accounting module. Any financial dimension can be configured as a cost object;

- Statistical Dimension – which is used to capture non-financial entries.

Dimensions Hierarchy

The dimension hierarchies can be created based on all three building blocks, which are the cost element, cost object, and statistical dimensions. These are very instrumental when we will talk about the reporting structure that fits the organization’s requirements.

In addition to providing reporting structure, the dimension hierarchy also has a very crucial role to play when we are defining cost accounting policies.

Also, if you are interested in building security policies – the dimension hierarchy can also be used to define security setup in what kind of access you would like to provide to the cost center managers.