In this particular topic, we would like to focus on industry accelerators, which provide a lot of possibilities and ways to leverage these accelerators obtaining the power of Power Platform through model-driven apps, portals, and so on.

Even though the Dataverse enables horizontal consistency for customers’ business data, making it easier for them to create value from data – many customers and partners want solutions that are tailored specifically for their industry. As a result, Microsoft has been working closely with representatives from various industries to make the Database more relevant to these organizations by creating industry accelerators.

Industry accelerators are foundational components within the Microsoft Power Platform and Dynamics 365. They enable ISVs to quickly build vertical solutions, extending Dataverse to include new entities to support a data schema for concepts within specific industries.

Microsoft is currently focused on delivering accelerators for the following industries, with more to come in the future:

- Automotive

- Financial Services (both banking and insurance)

- Education

- Nonprofit

- Manufacturing

- Media and Entertainment

ISV Opportunity Flow

The Microsoft Power Platform creates a unique opportunity for ISVs to deliver industry-focused applications for different scenarios and levels of development. These opportunities exist whether you are building directly on Power Apps or on top of Dynamics 365 applications in the Dataverse.

The accelerators provide opportunities to rapidly build vertical industry-focused apps, in addition to enabling system integrators to help scale and support these new apps and solutions. If you or your customers are in one of these industries, these accelerators can make it easier to develop solutions quickly. However, it’s important to note that there are no out-of-the-box integrations with Finance & Operations apps and the industry accelerations.

But, instead of creating custom entities, tables, forms, and so on in Finance and Operations apps using X++, you can consider leveraging these accelerators for their data models building solutions and apps on top of it. You can use the dual-right data integrator or virtual entities to configure the data flow into or out of F&O.

Use Cases

Higher Education Industry Accelerator

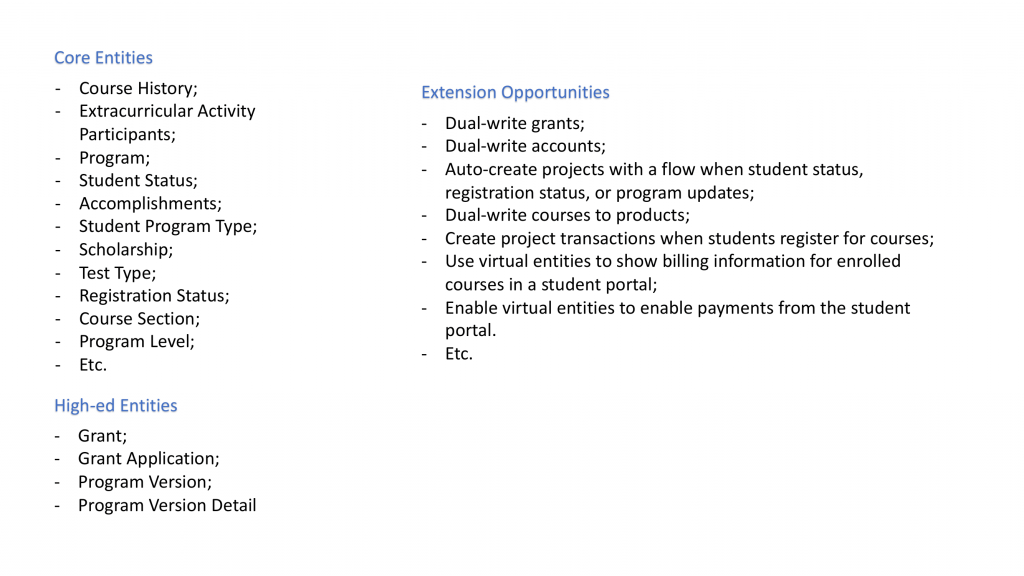

There is an exhaustive list of entities organizations can get with the Dataverse and the higher education industry accelerator, including course history programs, student status, and so on. There are also some additional entities that are available specific to higher education – grant management and program management, for instance.

When we start thinking about how we might use higher education industry accelerators with F&O, there are a number of different ways to leverage.

As an option, you might dual-write grant-information over to grants in the project management and accounting, dual-writing the programs over as projects. Then, you can dual-write accounts, so the account entity represents things like students, faculty and etc. Moreover, since those students are likely paying fees (i.e. tuition) as a part of their engagement with your organization, you can make students customers in F&O in order to track those details avoiding double-entry of that account information.

Another way to leverage this accelerator is to create projects automatically once student status, registration status, or program updates are happening inside of the model driven apps.

You could also dual-write courses you are selling to product entities in F&O enabling you to sell ones either through a sales order or project transactions like an item transaction. Project transactions can be created automatically, so when a student registers for a course, they might do that online through a portal, or directly through the higher education model-driven apps.

As the icing on the cake, you can use virtual entities to show billing, invoice, payment information that is happening in F&O and display that out in both model-driven apps and the student portal.

K-12 Industry Accelerator

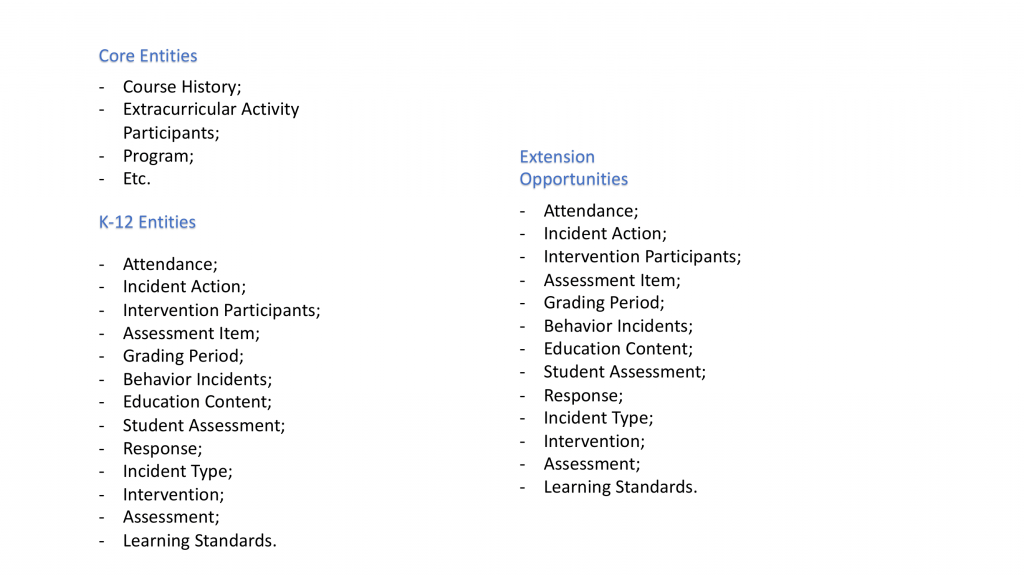

This accelerator is kind of a brother to higher education, so if you are an organization that manages both of those things it is possible for both to co-exist. But there are separate apps and entities that are specific to each one.

K-12 entities include things like attendance, education, content, behavior, incidents, interventions, and so on. In regards to extending the accelerator to work with F&O, there are a variety of things we can do:

- Firstly, if you are using donation functionality, you can dual-write these donations back to F&O to post and track the financial details. Then, donations can be linked (i.e. dual-written) with created projects for programs. Oftentimes, when those donations are made, they are going to fund different projects and programs that you are putting in place.

- You could extend the parent-student portal, which is provided out-of-the-box and includes things like homework, grades, and attendance. Moreover, you could extend this with virtual entities and allow parents to pay for book fees and other expenses that you are recording back in Finance & Operations.

- You could also use virtual entities to display past payment and invoice information out in the same portal or in the model-driven app in the Student 360 View.

Nonprofit Industry Accelerator

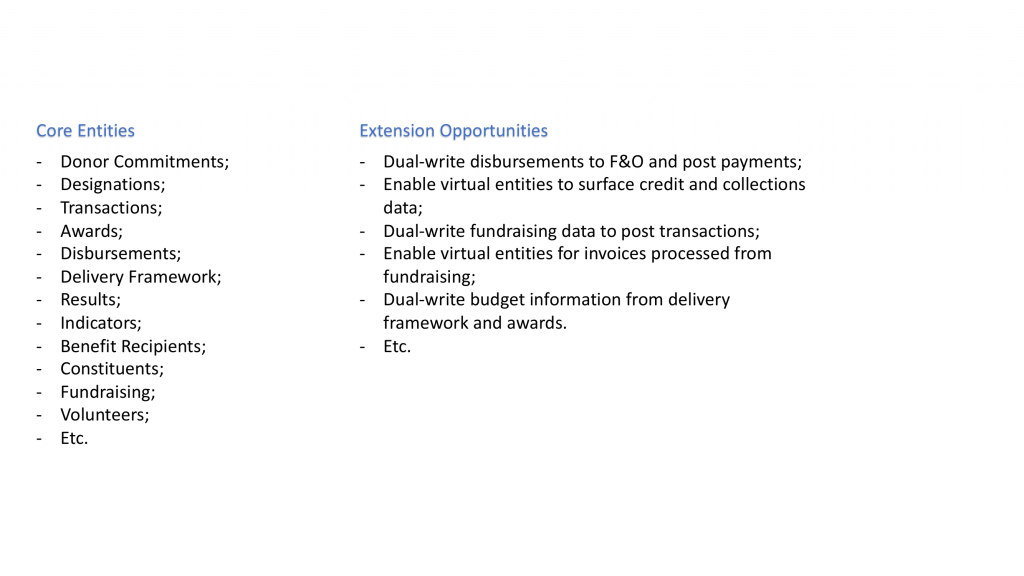

Next up we have is the nonprofit industry accelerator, which has a lot of different entities around transactions, awards, disbursements, and so on. There’s also a delivery framework (which is actually a separate model-driven app) and there are apps that are specific to fundraising and volunteer management as a part of this nonprofit accelerator.

So how might we extend and use this one with Finance & Operations? Well, we’ve got a variety of cases, mainly:

- We can dual-write disbursements to F&O, post those payments and get the financial aspects of that disbursement tracked in the system.

- We can enable virtual entities to surface credit and collections data, creating a concept of membership. People will be able to satisfy, i.e. to pay monthly subscriptions letting you surface collection information. Eventually, you will know who’s made the payment and who might need to be followed up.

- Fundraising data can be dual-written to post transactions inside of F&O. So in case the money that has been fundraised goes into an actual fund that supports a specific project, you will have all the records related to revenue and income in your general ledger.

- You might also enable virtual entities for invoices that have been processed from fundraising, and there are several places that have budgeting capabilities built into the industry accelerator related to awards and the delivery framework, or a few other places, for example. But that budgeting information could be dual-written over to the budgeting module inside of F&O.

Manufacturing Industry Accelerator

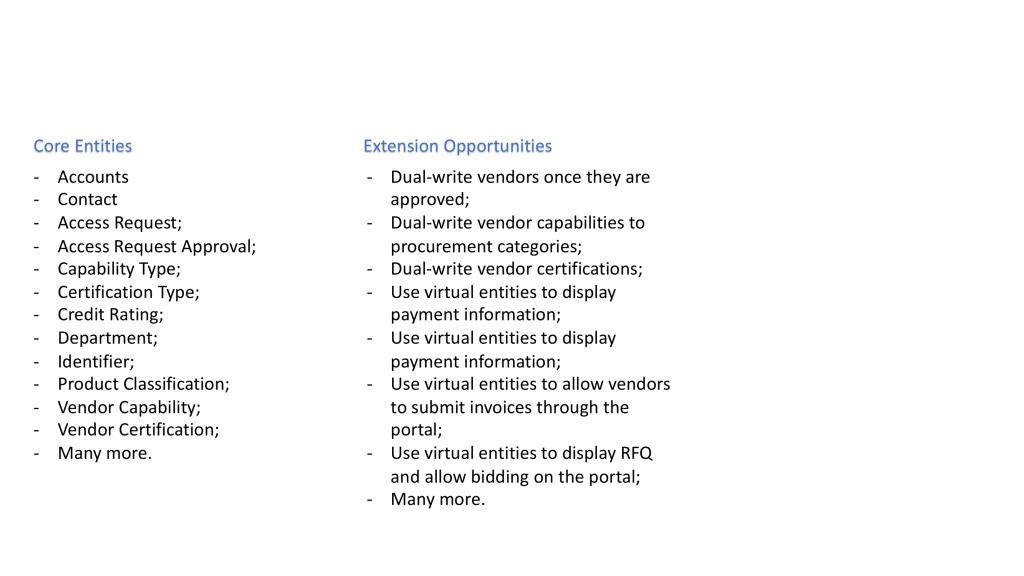

Manufacturing industry accelerators include such core entities as accounts, contacts, access requests, capabilities, and so on. It is probably one of the easiest ones to connect the dots with Finance & Operations since we have got an entire production control module that is all centered around manufacturing.

With the base functionalities that are available out-of-the-box, there’s a number of things that we can dual-write. For example, we might manage the whole onboarding and application processes for vendors. Then, once they are approved, we might dual-write those over into Finance & Operations so that they are actual vendors in the system and we can start capturing purchase orders and invoices, and payments.

We might also dual-write the vendor capabilities that you can capture in the model-driven app.

There is a concept in Finance & Operations that allows us to link procurement categories which indicate the types of products that vendors can supply. It has downstream functionality to be used with procurement categories, like Thunder Search, for example.

There is a concept of certifications on the vendor accounts allowing you to dual-write those certifications that are being uploaded through the portal or entered indirectly through the model-driven app into Finance and Operations. That information can be used later to determine workflows in downstream processes, in case a vendor has the proper certifications to place a purchase order.

The industry accelerator has some ways to extend model-driven apps and portals that already exist using virtual entities to transfer information in Finance & Operations, such as payment or invoice information, displaying that out in the model-driven app or in the supplier portal.

Users are also allowed to utilize virtual entities letting vendors submit invoices through the portal. As for another example, you could use virtual entities to display RFQ information, request quotation information, and allow bidding on the portal.

Automotive Industry Accelerator

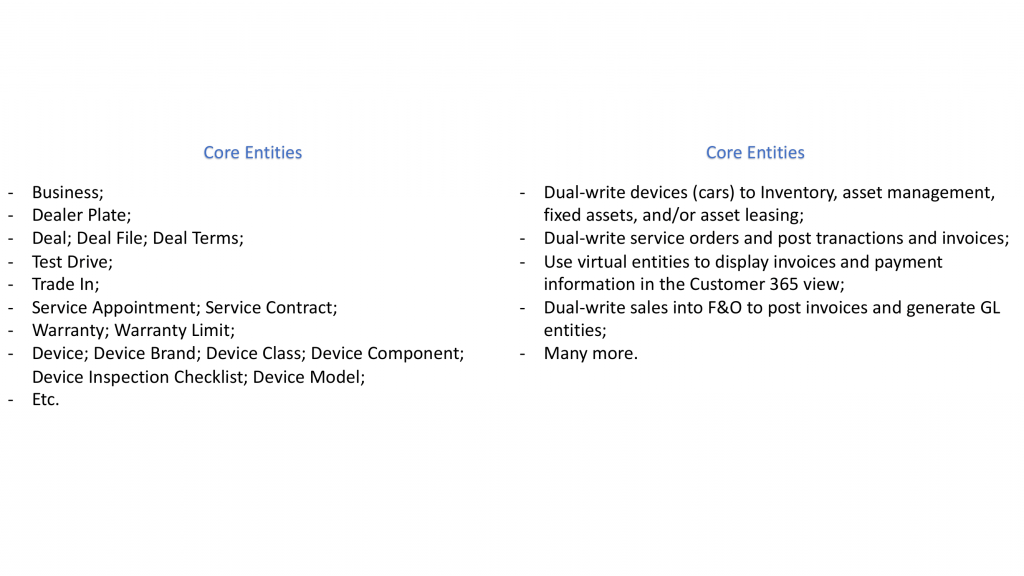

Next up we have the automotive industry accelerator which is not really focused around automotive in terms of manufacturing but is related to car dealerships, referring to devices, which actually could be anything automotive – a car, golf cart, tractor and etc.

The accelerator gives an ability to track all of the detailed information related to those vehicles, including the sales process (which is oftentimes referred to as a deal), deal tracking, trade-in managed services, warranties, and a lot more that’s a part of those core entities that come out-of-the-box with the automotive accelerator.

Some things that you might do to extend and use the automotive industry accelerator with Finance & Operations include:

- dual-writing your devices like cars over to your inventory, linking those over to asset management.

- If some of your vehicles or autos that are in your stock are actually fixed assets – you could record those as assets if they are being leased. Then, you could dual-write those over into asset leasing.

- You can also dual-write your service orders, post transactions, and invoices inside of Finance & Operations to record the financial and inventory aspects of your service shop at your dealership.

- Finance & Operations virtual entities can be used to display invoices and payment information in the Customer 365 View. There’s also an ability to dual-write the sales that are happening or has recently happened.

Media and Entertainment Industry Accelerator

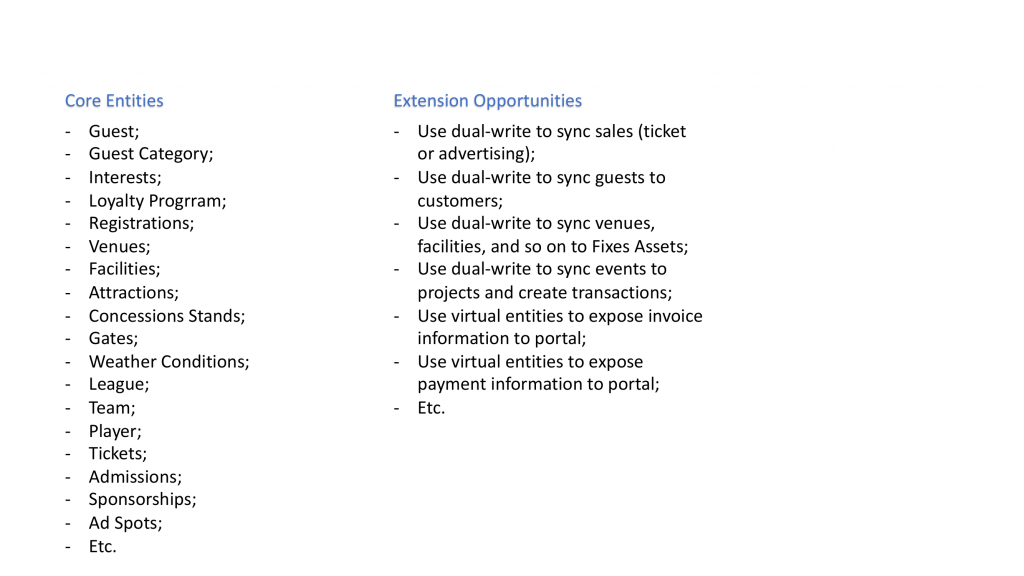

The last one here would be the media and entertainment industry accelerator, which has a couple of different areas that it focuses on since we’ve got guests, guest management, event management, sports management, media, and ad sales management.

There are a number of different things that we can do to support different types of media and entertainment industry type use cases:

- From extension opportunities, we can use dual-write to synchronize ticketing management apps with Finance & Operations to ensure a more consistent sales process.

- If you are using a guest management application to manage guests, you can use dual-write to transfer guest information data right into F&O, making your guests customers in the system. Or, you may dual-write various different venues, facilities and media type devices to the fixed assets module, tracking and depreciating them.

- Events can be synced to the project module creating transactions and capturing costs and revenues together.

- You might also use virtual entities to expose invoice and payment information out to a portal. Once your guests purchase tickets or register for events, you will be able to expose that info out to a portal allowing people to make payments directly on your portal.