As we dive into production costing, let’s talk about some high-level concepts. No matter what costing methodology you are using, there are several reasons why production costing is essential.

Variance Tracking

First, this is the ability to track variances. Analyzing variances is even easier when using standard costing since you can track those changes in your general Ledger. With any costing methodology, analyzing variances can help your organization spot a problem or a shift in the supply chain.

Variance can come from equipment that is not operating sufficiently. A change in worker and work behavior, purchase costs, and much more.

When you can analyze and react to variances, you are empowered to cut costs and improve margins, which are the goals of most organizations.

Accuracy of Costing

Next is the accuracy of costing. Suppose you estimate your costs by guessing which items are picked for an order or summing up labor costs and allocating them evenly to all production orders. In that case, you have likely no idea what it costs to produce particular items. Sequentially, it can lead to poor decision-making on the production floor.

On the other hand, should you take steps to build more accurate routes, you can more accurately define the expected cost for a produced item and then monitor the variances. Again, giving you the power to reduce costs and increase margins significantly.

Traceability of Costs

Lastly, traceability of costs. While traceability is critical, in some industries (like the food industry, for example), being able to trace costs can tell you where the problem is AND precisely in your production process.

It can help you determine if you have a supply chain, quality, machine, or workforce issue, letting you narrow down analytical efforts. But, keep in mind that accuracy brings more details to the dashboard and may create overhead in your manufacturing process.

Weigh benefits against the effort cost to consider whether automation may be needed.

Production Costing Concepts

When we analyze how the cost of a production/batch order is determined, we can see three main components that make up the cost:

- Material Costs are for the items and subcontracted services you include in your formulas. This can represent raw materials or sub-assemblies that are consumed to make a finished product. Material costs are typically recorded based on the quantity of items or services consumed;

- Labor Costs – shop floor operations, machines used in production, work cells, etc. Labor costs are typically recorded as a function of production time or the quantity produced;

- Indirect Costs – also known as overheads, represent costs like rent, utilities, machine depreciation, SGNA expenses, etc. Indirect costs are calculated as input material, labor time or costs, or output units.

Once you add all these up, they create the cost of conversion, which is the total cost of a manufactured item. Let’s take a quick look at how and where the costs are sourced in the three different manufacturing processes that are supported in Dynamics 365.

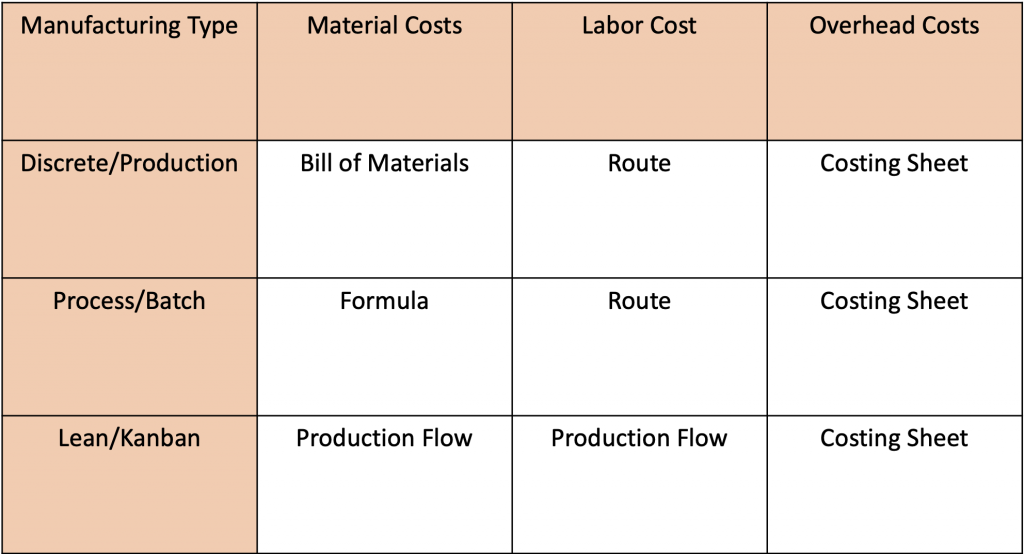

In the table, we have each of our manufacturing types discrete, which uses production orders, process manufacturing (which uses batch orders), and lean (which uses combines).

For discrete manufacturing, material costs are derived from the Bill of materials, whereas labor costs come from routes with overheads coming from the costing sheet.

Process manufacturing is very similar, but it uses formulas to track material costs instead of a Bill of Materials.

However, Lean manufacturing is very different from them both. It uses production flows to track the material and labor costs of our combines, without assigning costs to specific combines as we do for production or batch orders. We do still use the costing sheet with lean to calculate overheads.

You can further classify your material, labor, and overhead costs by using cost groups, whether you use a mixed manufacturing mode.

Cost Components

Now that we have a basic understanding of components and the importance of production, we will dive into the details of how the cost is calculated for each of these components.

Bill of Materials

Let’s review the components and configuration used in a Bill of Materials. Bill of Materials is the list of items that we consume to create or finish a product.

A Bill of Materials (also known as BOM) defines the necessary components to produce a product. These can be raw materials, semi-finished products, or ingredients (services can also be referenced in a BOM, although it is not typical).

Cost Categories

In the most simple terms, cost categories are used to define the cost of labor. They only apply to manufacture environments that utilize routing. You can assign them to resources, resource groups, and route operations in Dynamics 365.

Cost categories are known by several other names, such as labor rate codes or machine rate codes. Although you can’t type directly into the cost field on the cost category, you can use the field to view the current active cost.

*The costs are added through the costing version, which you can access by clicking on “price” on the cost categories page. There is also an ability to link the cost category to a specific worker.

Cost category Considerations

When you consider how many cost categories to create, there are several considerations that you will want to keep in mind.

Accuracy

Firstly, it is all about accuracy. It is important to note that each cost category can have one cost defined per site. If you need a different cost for each machine in your production facility, you will need one cost category per resource.

If you have the same machine in many facilities or multiple of the same machine, and they all have the exact cost, you can create one cost category linked to a resource group or various resources.

The same principle applies to people in your operations. If you have created each production floor worker in your warehouse, you can create one cost category for each person that directly correlates to the worker’s compensation.

This is a very high level of detail and is not common. It is more likely that you will create one cost category for all human labor with a blended average rate or a handful of cost categories for different types of workers or levels of workers, for example.

Remember that if the same resource is used in more than one site, you can specify the cost per site with no need to create one cast cost category for each site.

Ledger

The next consideration is for the Ledger. There is a couple of basic ways to post labor-related cots to the Ledger. The most straightforward way is by using the ledger account specified on the resource, followed next by the resource group. Cost categories is the most common way to specify Ledger accounts, though.

Details

Lastly, there are additional detailed settings and considerations:

- Remember that each cost category links to one cost group, while many cost categories can be connected to the same cost group;

- Your cost categories are likely to be more detailed than your cost groups;

- You will be able to report on your cost by cost categories (so you will want to think about the reporting requirements from a sub-ledger standpoint).