When selling subscriptions, memberships, or prepaid investments, companies often receive large sums of money upfront from their customers and cannot recognize that revenue immediately. This can cause accounting and cashflow issues if the money was immediately available as revenue all at once.

Therefore, Microsoft Dynamics 365 for Finance offers Revenue and expense deferrals as part of their new Subscription billing offerings. Revenue deferral allows the revenue to enter a deferred account and be recognized on a schedule to be defined by the accounting team. Let’s discuss how to set this up.

The subscription billing module itself is three modules. Those modules are recurring contract billing revenue, expense deferrals, and multiple-element revenue allocation. These are all controlled in feature management and were shipped in 10.0.25. Meaning, if you are on this version you can turn these features on. Needless to say, it is compliant with IFRS 15 and ASC 606.

One caveat is that the revenue recognition feature (that’s part of the General ledger) is not compatible and must be disabled first – and vice versa. You can only run subscription billing OR revenue recognition.

The revenue and expense deferrals can be straight-line, event-based, and percentage of completion. They can follow billing or be created from a template, based on the settings you configure. We can also make credit adjustments and apply those to our deferral schedules.

Where can deferrals be created?

We can create deferrals from a General journal; accounts payable invoice journal; and vendor invoice. You can also do the deferral from the accounting distributions, for a vendor invoice scenario for instance. For that, you have to be in the invoice step and then go to the distributions and you will see the deferrals button.

Fundamental Concepts

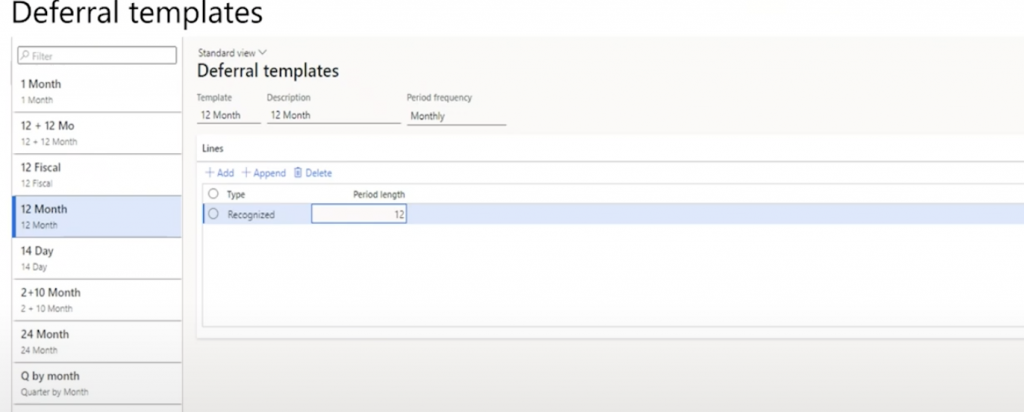

Deferral Templates

Deferral templates are part of the setup of Revenue and Expense deferrals. These templates can tell us how we want to defer or protect particular scenarios.

In this case, the one which is highlighted is going to be recognized over 12 months. So what this means is we have a monthly period frequency. We also have a type of ‘recognized’ with a period length of 12. If that period length was six, it would be six-month installments of recognition.

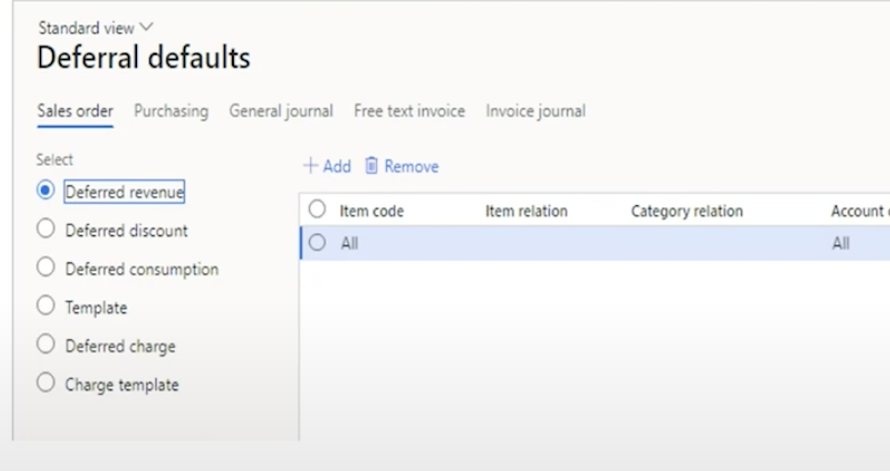

Deferral Defaults

The next setup that we have is deferral defaults. These are the default accounts that would come into play based on your setup. Here, you will see tabs across the top for sales order purchasing, general journal, free text invoice, and invoice journal.

And then you also have posting types along the left-hand side:

- Deferred revenue;

- Deferred discount;

- Deferred consumption;

- Template;

- Deferred charge;

- Charge template.

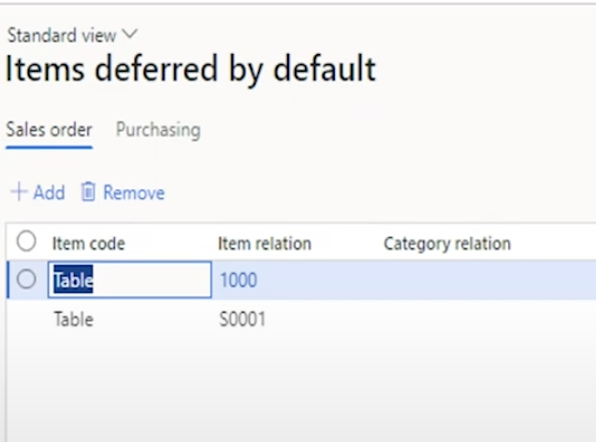

Items Deferred by Default

If we want an item to be deferred by default, we can do so as an optional setup. Once set, deferral will be created automatically once an item is used in a scenario. Thus, you don’t have to go and click the box for deferrals, specify a template, or else – you will have all that set up for you.

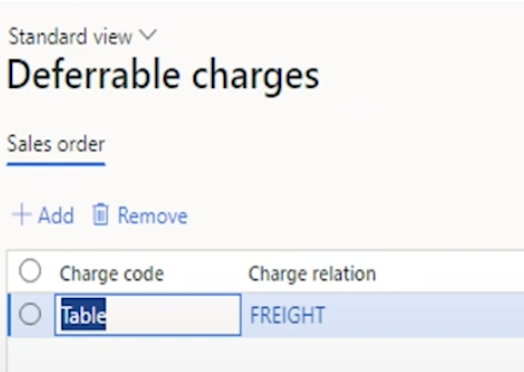

Deferrable Charges

We can also defer charges through the Deferrable Charges concept setting up the charge. You can set it up by table group depending on the charges. In this case, it’s done for a specific charge for Freight.

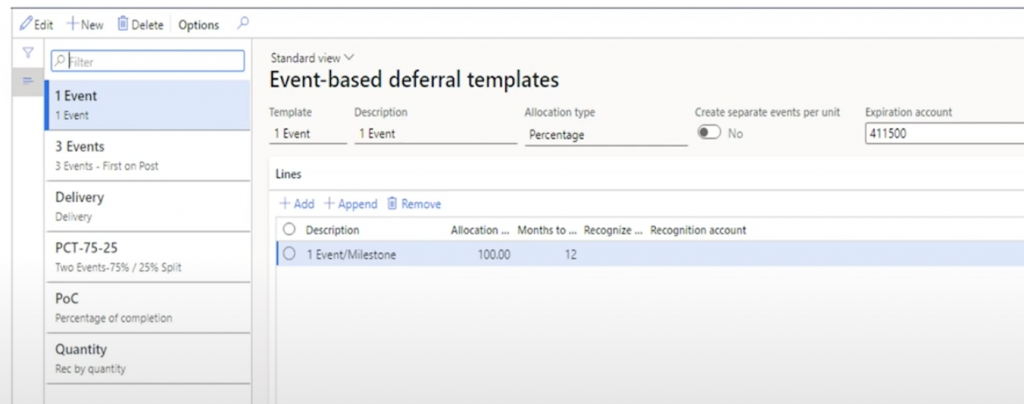

Event-Based Deferral Templates

Event-Based Deferral Templates – these templates will be a little bit different than straight-line templates. In this case, you can have events or milestones that will determine when that revenue gets recognized.

In this example, it’s done based on a percentage and we allocate a percentage on that event. Since it happens to be one event – 100% will get recognized.

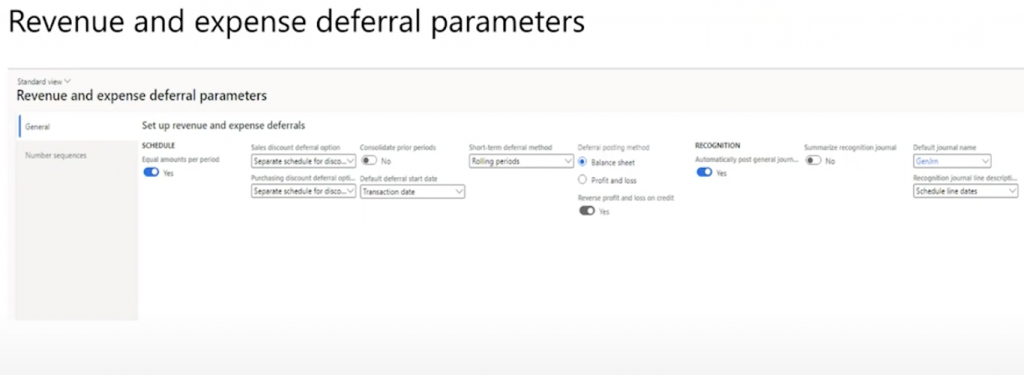

Revenue and Expense Deferral Parameters

The last step is Revenue and Expense Deferral Parameters. This is the concept where we specify:

- whether we want our allocation to be equal amounts per period;

- how do we want to handle discounts (do we want to separate them from our original schedule, or do we want these combined);

- For prior periods, do we want to combine periods together;

- what should the deferral start date be;

- and so on.