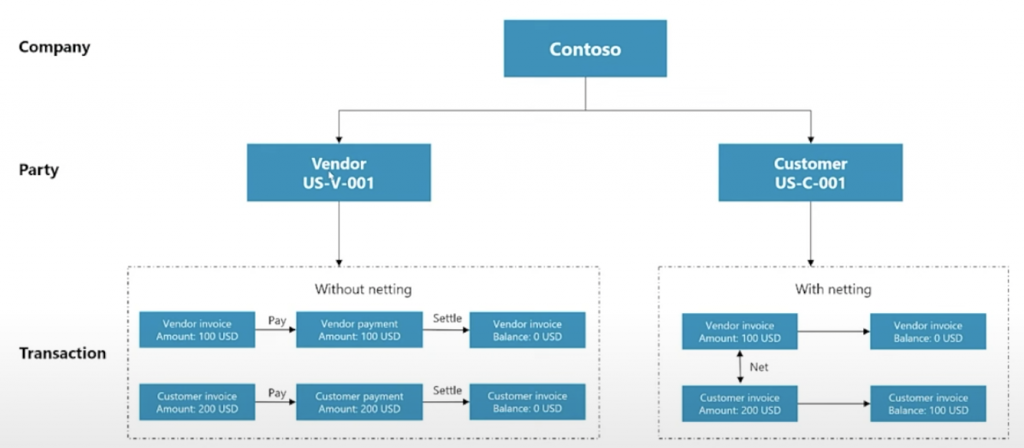

In real business scenarios, it’s not uncommon for a company like Contoso to wear multiple hats, acting as both your vendor and your customer within the Dynamics 365 Finance application. Contoso may be designated as your vendor, say under the code US-V-001, while also being your customer under US-C-001. Consequently, you engage in both purchasing and sales transactions with this entity.

Before delving into the intricacies of Customer and Vendor Balances Netting, let’s consider the conventional process. Without netting, you’d typically receive a vendor invoice, let’s say for $100, alongside a customer invoice amounting to $200. This necessitates separate actions: posting a vendor payment journal to clear the vendor invoice, followed by the sale to the vendor through another payment journal, effectively settling both sides.

This process results in the vendor invoice balance being zeroed out, alongside the assignment of a custom payment channel to the corresponding customer invoice, thereby nullifying its balance as well.

That’s the traditional route—managing transactions separately without netting.

Now, enter the game-changer: netting feature. With netting enabled, the procedure becomes remarkably streamlined. You can directly offset the vendor invoice against the corresponding customer invoice.

By doing so, the vendor invoice balance is automatically reduced to zero, while the customer invoice balance reflects the remaining amount, in this case, $100. What’s more, you only need to execute a single custom payment journal, amounting to $100, to settle the remaining balance. There’s no need for additional steps concerning the vendor invoice.

This streamlined approach not only saves time but also enhances efficiency in managing dual transactions involving the same counterparty.

Netting Benefits

The netting feature offers a myriad of benefits that can significantly enhance your financial operations:

- Optimize Cash Flow: With netting, you eliminate the need to make a separate payment to the vendor, resulting in significant savings in outgoing payments. By directly offsetting the vendor invoice against the corresponding customer invoice, you retain more control over your cash flow, allowing you to allocate resources more efficiently.

- Reduce Operation Costs: Operating costs can be minimized with netting, especially if your bank imposes fees for each transaction. By consolidating multiple transactions into a single payment through netting, you effectively reduce the number of outgoing payments, thereby mitigating potential bank fees. This consolidation streamlines the payment process, leading to cost savings over time.

- Improve Operational Efficiency: Netting facilitates operational efficiency by automating the settlement process. Batch jobs or automation can be scheduled to run periodically or daily, ensuring that transactions are reconciled swiftly and accurately. This automated approach not only saves time but also reduces the risk of errors associated with manual processing, ultimately enhancing operational efficiency across your organization.

- Avoid Dummy Payments and Dummy Bank Accounts: Netting eliminates the need for dummy payments and dummy bank accounts, which are often employed in conventional payment processes to manage dual transactions with the same counterparty. By directly offsetting invoices, netting streamlines the payment process, eliminating the need for unnecessary intermediary steps and associated accounts. This simplification reduces complexity and enhances transparency in your financial transactions.

Core Capabilities

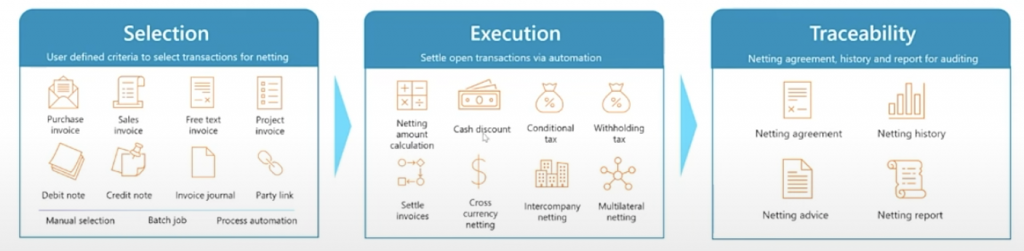

The Dynamics 365 Finance netting feature is built on three core capabilities:

- Selection: This function efficiently gathers open invoices by employing manual selection, batch job processing, or automated methods. By providing flexibility in how invoices are identified and grouped, this capability lays a solid foundation for subsequent netting processes.

- Execution: Once invoices are selected, the netting feature swings into action, calculating the estimated netting amounts for both customer and vendor invoices. It then proceeds to generate and post netting journals to settle these invoices, streamlining the settlement process and ensuring accuracy in financial transactions.

- Traceability: Transparency and traceability are paramount in financial management, and the netting feature delivers on this front. It provides access to netting agreements, historical data, and comprehensive reports, offering a clear audit trail of netting activities. This capability enables organizations to maintain accountability, comply with regulations, and make informed decisions based on insights gleaned from netting performance and trends.