Electronic invoicing for Dynamics 365 is a hyper-scalable multitenant service that became generally available last year (2021) as a component of the globalization services portfolio. It basically extends invoicing previously available in Dynamics 365 enterprise applications.

Needless to say, that microservice platform is only available for cloud deployments of Dynamics 365 Finance & Supply Chain Management and project operations. It is not integrated, for instance, with business central or earlier versions like Microsoft Dynamics 2009 or 2012.

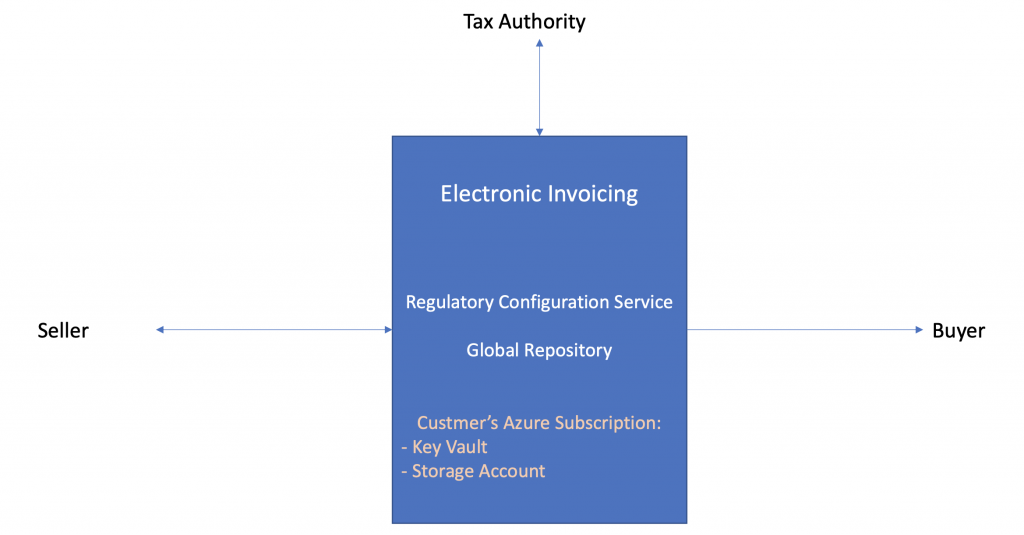

Extending regulatory configuration service with the concept of globalization feature combining reconfigurability of electronic reporting and introducing new processing pipelines – the MS provides new electronic invoicing service mechanisms for extensibility by configuration, delivering more and more countries-specific invoicing solutions.

In 2021, globalization features were published for almost all previously available Dynamics 365 invoice formats, adding brand new solutions for Indonesia, Egypt, and Italy.

As for planned capabilities for 2022 Waves, the MS team plans to deliver better electronic invoicing solutions, covering:

France – updates format and integration with Chorus Pro;

Poland – new format and integration with KSeF;

Saudi Arabia – updated format and integration with Saudi Fatoora system.

Apart from country-specific solutions, we expand service capabilities, among others, through a set of APIs to let the electronic invoicing service be integrated with any other first and third-party applications.

Electronic Invoicing Processes

France, Poland, and Saudi Arabia have different terms for required formats, integration principles, and overall processes. But, all new invoicing solutions have a common denominator usage of electronic invoicing service.

While not all the capabilities and available processing actions might be required in all the countries, the mechanics behind the solution stays the same.

Once a clerk at a selling company posts an invoice – the document represented as unified structured business data is sent to electronic invoicing service. The service, based on preconfigured rules, selects a globalization feature previously imported from a global repository and executes globalization feature logic enabled via regulatory configuration service.

If necessary, the service signs the transformed invoice and sends it to the authorities for acceptance (processing any responses) using secrets stored in the customer key vault. Then, all the executed actions are logged for audit trial, with responses and messages stored in customer storage.

Finally, Built-in integrations with Microsoft 365 and SharePoint help with the distribution of created invoices and received invoices issued for our company.

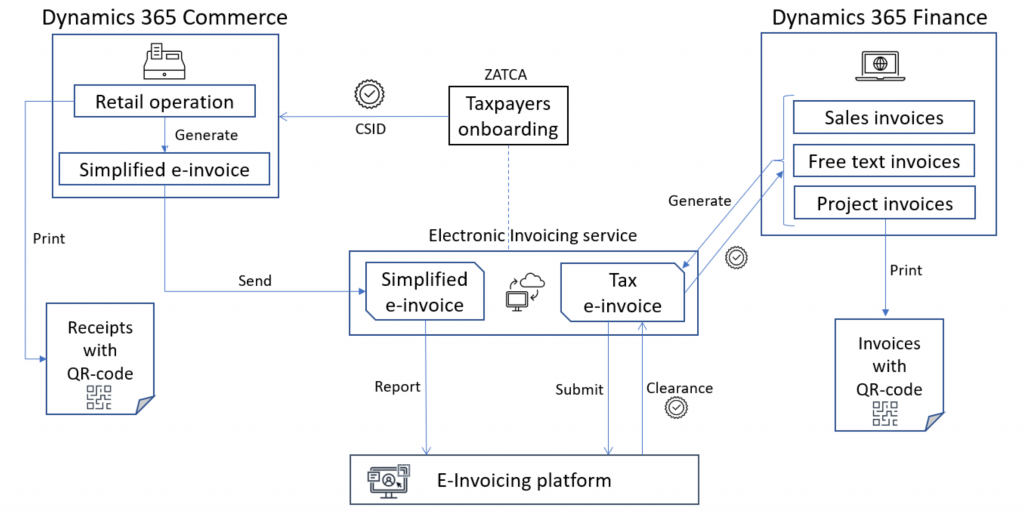

Saudi Arabia

Every taxpayer must be additionally registered (especially for electronic invoicing) to normal tax registration. As a result of onboarding, a so-called cryptographic stamp identifier (CSID) will be obtained. The identifier will be used in retail operations from the very beginning and indirectly used in the ERP path.

In Dynamics 365 Finance, invoices cover all supported invoice types: sales invoices based on sales orders, pretext invoices, and project invoices. The related credit notes and debit notes are also covered.

Once an invoice is posted in Dynamics 365 Finance, users can generate related electronic invoices using invoicing service.

Tax invoices or simplified tax invoices can be generated by the service for different business scenarios. Once the tax invoice is generated, you will be submitted by the service to ZATCA for collisions.

ZATCA service validates the invoice and, in case of no errors, updates the XML file of the original invoice with the new block for CSID and another element with the QR code.

Then, the updated XML fulfilled will be sent back to the invoicing service. Then, the invoicing service updates original invoices in Dynamics 365 Finance with QR codes and some other technical data.

For retail operations, in Dynamics 365 commerce, fiscal receipts should be printed directly from the point of sales terminals with the proper QR codes. That’s why CSID must be obtained in advance.

Simplified tax invoices should also contain CSID data, since they will be generated on the retail side and sent to the invoicing service for submission only. Invoicing service submits simplified invoices to ZATCA portal for reporting purposes. No business response is expected from ZATCA.

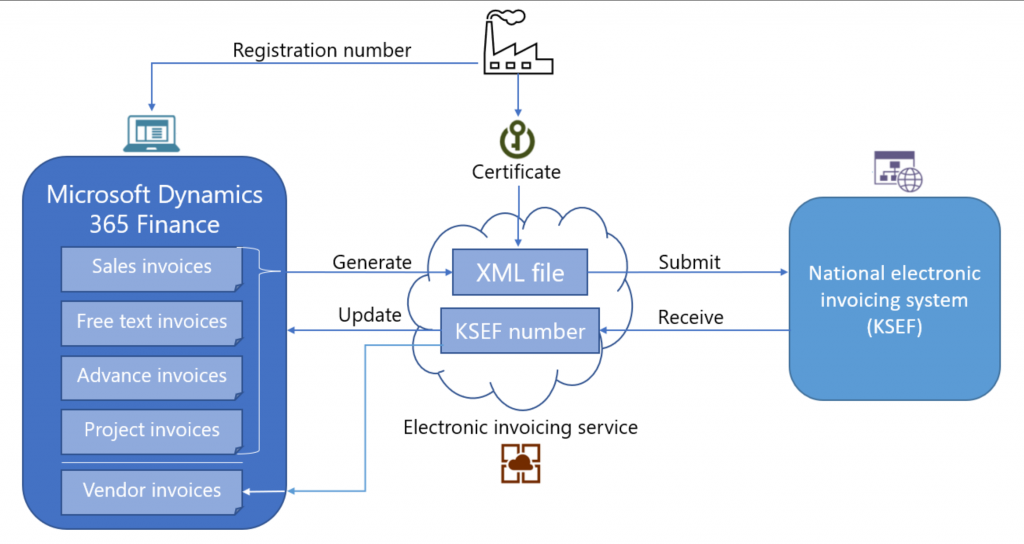

Poland

In Poland, starting the next year, all the taxpayers will be obliged to send and receive invoices only in electronic format and only via the KSeF system (a special portal introduced by Polish authorities).

When it comes down to implementation, no additional registration is required for electronic invoicing. Participants must be simply registered with Polish tax authorities as usual.

Taxpayers must also have the certificates for the digital signing of outgoing invoices and for establishing a connection to KSeF system.

In Dynamics 365 Finance, invoicing covers all supported invoice types: sales invoices based on sales orders, pretext invoices, project invoices, and advance invoices (which are specific for Poland).

It is also planned to support incoming vendor invoices import as well. Vendor invoices can be retrieved from KSeF by the invoiced service using the exact numbers.

France

As for France, there is a legal requirement to generate invoices in electronic format and use an intermediate platform for communicating. Currently, this system and process work for a business to government submissions and communications. But, the government, starting from the 1st of July 2024 and gradually up to the 1st of January 2026, will require companies to start using this platform.

There are also specific technical requirements to satisfy the legal requirements, which are related to the structure of the documents. They are as follows:

- Formats INVOICE UBL, UN/CEFACT CII, and Facture-X are accepted, as well as PDF files;

- Digital signatures of XML documents are not expected, PDF must be digitally signed;

- Submission and receiving of the XML documents must be done using Chorus Pro service (as the certified service provider).